Precision Can Improve Claims Process Beyond Yield Losses

The cooler, wet weather in many regions across the U.S. this season has slowed harvest and may impact yields, but another major factor for potential losses this year could be crop price. Whether a farmer suffers a loss from lower yields, crop prices, or general crop damage, Precision Claims can speed up the adjustment process.

What is a Precision Claim?

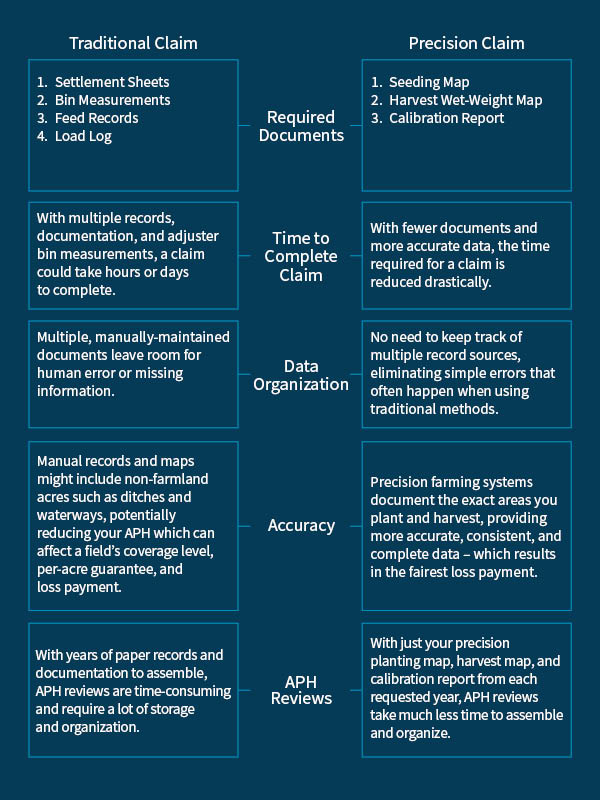

Precision Claims are crop insurance claims that are adjusted by utilizing the data recorded by a farmer's precision farming technology. They can be adjusted using only a few pieces of documentation and records from their farm management software, and take only a fraction of the time to complete. Data is accurate, consistent, and complete — resulting in the most fair loss payment.

Did You Know FMH Can Use Reported Data for an Insured's Claim?

If precision data has been submitted to FMH for acreage and production reporting, FMH can use the reported data for an insured's claim, which means the only information needed to submit to an adjuster is the calibration report. Please note that all loss adjustments are unique, and the adjuster may ask for additional records if needed.

Use ACR to Complete the Precision Solutions Experience

The farmer does not need to report planting or production via Automated Crop Reporting (ACR) to use precision data for a claim, but the process is encouraged for a faster and more seamless overall crop insurance experience. Read more about ways to submit precision data for reporting.