Individual Non-Disclosure

RMA Releases New Non-Disclosure Statements

Farmers Mutual Hail would like to inform all agents and agency owners that the Risk Management Agency (RMA) has made revisions to the Non-Disclosure Statement (NDS) process that protects personally identifiable information (Individual Non-Disclosure and Annual Certification). On January 5, 2009, RMA issued Managers Bulletin MGR-09-001 concerning Non-Disclosure Statements.

What Does This Mean?

RMA has implemented a two-step requirement with regard to the security of federal crop insurance policyholder information. The first step requires that ALL EMPLOYEES of an AIP affiliate, who have access to protected information or personally identifiable information on any MPCI policyholder will need to sign and submit an Individual Non-Disclosure Statement (NDS). While, an individual only needs to sign and submit the form once, they do need to be aware that each AIP that they are doing business with will need a signed NDS form. Any employee of an affiliate that has not signed an NDS form cannot be granted access to any protected or personally identifiable information for any policyholder. The AIP affiliate (or MPCI agency) must maintain a copy of all NDS forms and have them available upon request.

Submit Individual Non-Disclosure

Agency Non-Disclosure

RMA Releases New Non-Disclosure Statements

A more efficient option is now available via the secure FMH website for Master Agencies and Owner/Officers to complete the annual Agency Non-Disclosure Statement (NDS) process. This new option will allow Master Agencies and Owner/Officers to complete the Agency NDS process for multiple agencies using one online form.

IMPORTANT - Annual Certification for Agency Owners and Vendors!

The second step in the NDS two step process requires that by the end of March of each year, an owner/officer of the AIP affiliate (MPCI agency or vendors) must sign the additional Annual Certification that attests to the fact that all employees of the affiliate with access to protected or personally identifiable information have signed an Individual NDS form.

From this point forward, this will be an annual requirement at the end of March.

Available January 1st - March 31st

Conflict of Interest

As outlined in bulletin MGR-08-001, RMA requires all licensed and appointed MPCI agents to complete a COI form for each Approved Insurance Provider (AIP) that they write business with. To comply with these requirements, FMH will need all agents who are currently licensed, appointed, and writing MPCI with FMH to complete and submit a COI form to us by their earliest applicable acreage reporting date. To ensure that the form has been completed timely FMH will require and will prompt each FMHA user after each reinsurance year’s crop roll to complete a COI form upon signing in.

RMA reminds us in their bulletin that any changes to the COI Disclosure Statement submitted to an Approved Insurance Provider (AIP) for a given reinsurance year, must be reported by the discloser to the AIP within 15 days of entering into a relationship that requires disclosure (i.e. business, financial, legal, or familial relationships with an MPCI policyholder).

Farmers Mutual Hail would like to thank you in advance for your cooperation and assistance with this requirement. Please contact Julie Harris at 855-364-3276, ext.043 with any questions.

Guide to Complete COI

Step 1: Log into the FMH Agent Center

Navigate to the FMH Agent Center in your web browser and login using your credentials.

Step 2: Select Proper Reinsurance Year, Find & Click on Submit My COI

- From the home page, select the proper reinsurance year from the drop down.

- Find and click on Compliance > Conflict of Interest - Personal.

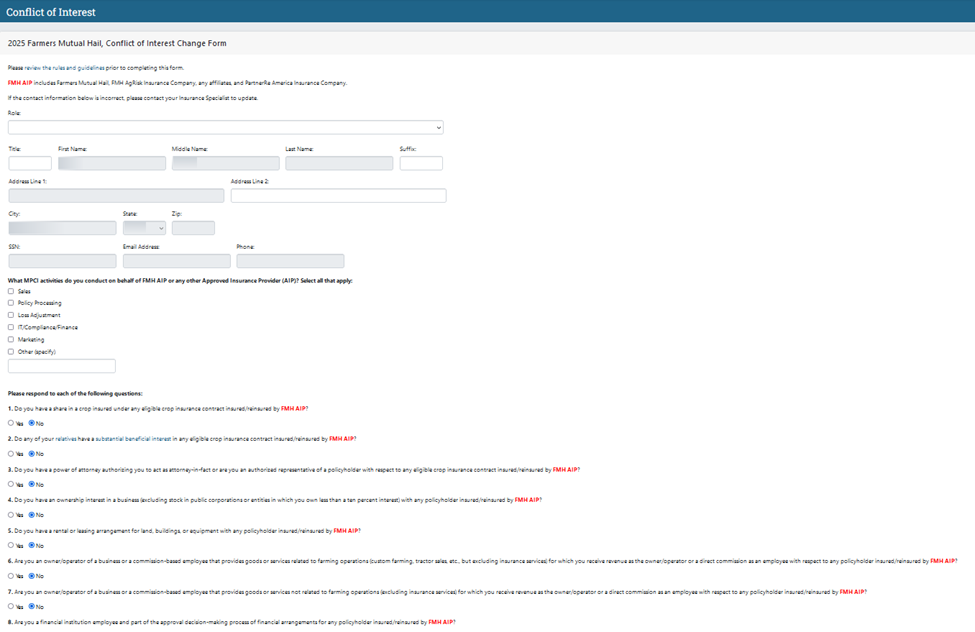

Step 3: Review Contact Information & Fill Out Form

Review your contact information which is pre-filled. If your contact information is incorrect, please contact your Insurance Specialist to update. Required fields are marked with a *red asterisk and must be completed to submit the form.

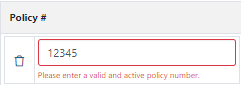

Only valid MPCI polices should be disclosed. If you receive the following error, please validate that the policy number is correct. Note: Only the 5-7 digit policy number, without the state, county, or reinsurance year, should be entered. For example, if the policy number is 12-110-0054321-17, you only need to enter 54321.

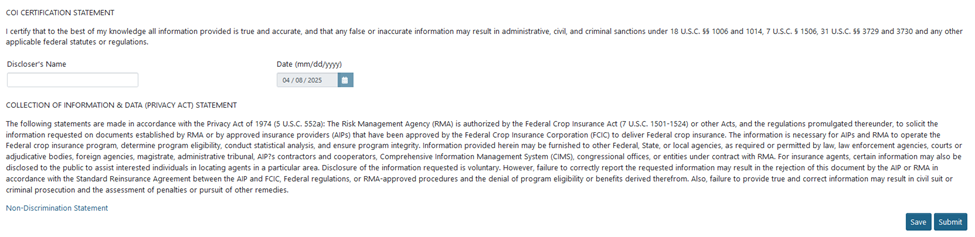

Step 4: Review, Sign & Submit or Save

Before submission, please review your responses to ensure all associated policies for a conflict have been disclosed. If ‘Policy Suggestions’ comes up, please review carefully and, if applicable, include the suggested policies. To submit the form, digitally sign within the Discloser's Name field by entering your full name and click the Submit button. You may click on the Save button at the bottom of the form to save your progress to return later to complete.

Controlled Business

Controlled Business Compliance Certification

On May 22, 2008, the Food, Conservation, and Energy Act of 2008 (2008 Farm Bill) became law. Section 12005, "Controlled Business Insurance," of the 2008 Farm Bill amends the Federal Crop Insurance Act by adding a new section 508(a)(10), which states:

- PROHIBITION - No individual (including a sub-agent) may receive directly, or indirectly through an entity, any compensation (including any commission, profit sharing, bonus, or any other direct or indirect benefit) for the sale or service of a policy or plan or plan of insurance offered under this title if

- the individual has a substantial beneficial interest, or a member of the individual's immediate family has a substantial beneficial interest, in the policy or plan of insurance; and

- the total compensation to be paid to the individual with respect to the sale or service of the policies or plans of insurance that meet the condition described in clause (i) exceeds 30 percent or the percentage specified in State law, whichever is less, of the total of all compensation received directly or indirectly by the individual for the sale or service of all policies and plans of insurance offered under this title for the reinsurance year.

- REPORTING - Not later than 90 days after the annual settlement date of the reinsurance year, any individual that received directly or indirectly any compensation for the service or sale of any policy or plan of insurance offered under this title in the prior reinsurance year shall certify to applicable approved insurance providers that the compensation that the individual received was in compliance with this paragraph.

- SANCTIONS - The procedural requirements and sanctions prescribed in section 515(h) shall apply to the prosecution of a violation of this paragraph.

- APPLICABILITY

- IN GENERAL.- Sanctions for violations under this paragraph shall only apply to the individuals or entities directly responsible for the certification required under subparagraph (C) or the failure to comply with the requirements of this paragraph.

- PROHIBITION.- No sanctions shall apply with respect to the policy or plans of insurance upon which compensation is received, including the reinsurance for those policies or plans.

*DEFINITION OF IMMEDIATE FAMILY - In this paragraph, the term 'immediate family' means an individual's father, mother, stepfather, stepmother, brother, sister, stepbrother, stepsister, son, daughter, stepson, stepdaughter, grandparent, grandson, granddaughter, father-in-law, mother-in-law, brother-in-law, sister-in-law, son-in-law, daughter-in-law, the spouse of the foregoing, and the individual's spouse.

Two-Step Controlled Business Certification Process

Step 1: Agents Complete Individual Controlled Business Form (fillable PDF)

Do not return the individual form(s) to FMH. These forms should remain on file with the agency.

Step 2: The General Agency submits the Controlled Business Certification Form once all applicable individual forms have been completed.

General Agencies must complete Step 2 in order to complete the process.

Available from October 1st to December 31st.

All MPCI writing agents are required to complete and submit the Controlled Business Compliance Certification form.

Covenant Not to Sue

RMA Requires Covenant Not To Sue

The Risk Management Agency (RMA) issued Manager’s Bulletin MGR-10-012.1 amending Bulletin MGR-10-012 that removes the required annual completion of the Covenant Not To Sue (CNTS) form. FMH has modified the language in our form to adhere to the new requirements of this amendment. Each agent appointed to write MPCI with FMH must sign this updated CNTS form and, after doing so, will no longer be required to complete the process again in successive reinsurance years. Please click the link below to proceed. Do not send FMH paper forms developed by other crop insurance companies or your agency. We are completing this RMA requirement with an automated and environmentally-friendly process.

What Does This Mean?

For any agent who chooses not to sign the agreement, FMH must terminate your appointment to write MPCI for our company. However, this will not impact your Crop Hail appointment.

Farmers Mutual Hail would like to thank you in advance for your cooperation and assistance with this requirement. If you have questions, please contact the FMH Help Desk at 800-532-1581 or send an email to helpdesk@fmh.com.