Founded 1893

1893: FMH Becomes a Mutual Association

"For years, I have felt the necessity of a mutual insurance against hail by farmers. During the growing season, every black cloud which appeared on the horizon has caused a feeling of uneasiness, and we have felt how the waving and ripening grain might have been mowed down by this terrible destroyer. Last March 1893, the farmers themselves came together and organized The Farmers Mutual Hail Insurance Association. The members are jubilant and believe they have at last got something that meets their wants."

-W.A. Rutledge, FMH Founder

Following the company's inception, W. A. secures 250 members through the solicitation of handwritten letters and printed materials. His wife, Jessie, handwrites 2,650 policies in three months’ time. W. A. ceases his occupation as a farmer and travels the countryside in pursuit of new policy holders. It is around this time that the family moves to Early, Iowa. FMH sets up office in the Early State Bank.

1895 W.A. Rutledge Organizes NAMIC

W. A. calls a meeting of insurance executives to address the need for a National Trade Association. Thus, the National Association of Mutual Insurance Companies (NAMIC) is established, though at first it's known as the 'National Association of Cooperative Mutual Insurance Companies,' with W.D. Forbes at the helm as President and W. A. Rutledge at his side as Secretary

1900 - 1949

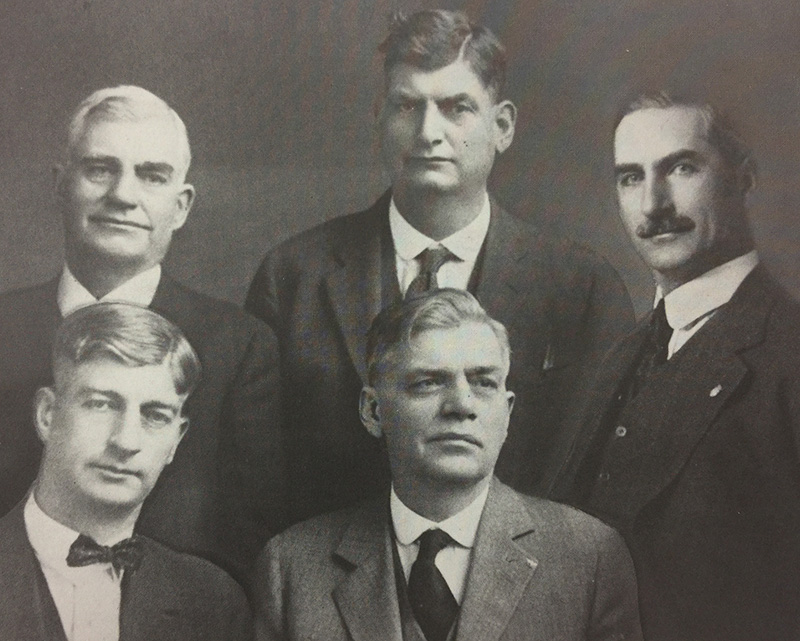

FMH Board of Directors Becomes a Rutledge Majority

Following an attempted takeover of the Board in 1902 coupled with high loss ratio years, W. A. places family members on the Board to strengthen the company's leadership and ensure its survival. FMH maintains a Rutledge family majority Board from this point forward, experiencing long-term stability and strength.

1905 "Value Per Acre" Claim Payments Are Implemented

The Board allows insurance to be written on a fixed value given to a crop, rather than then-common method of paying a claim on the market price per harvested bushel of the crop. This new method, the brainchild of W. A. and J. C. Baker, proves easier and more straightforward during a claim payment than the previous methods of determining yields and market prices. In the new manner of payment, the loss is determined on the percent of the crop lost. As a result, the concept of Value Per Acre is written into the Articles of Incorporation in 1913. This method of adjusting hail losses continues today.

1922 FMH Extends Crop Hail Business Into Nebraska

FMH continues to expand its writing area, moving into Nebraska. The expansion ultimately proves successful, and paved the way for FMH to begin growing its writing area even further.

1923 FMH Takes Control of Farmers Mutual Hail Insurance Company of Rockport, MO

The division is managed by Paul Rutledge, W. A.'s son. Over 60 years later, during the 1980s, the company is absorbed into The Columbia Group.

1932 FMH Extends Crop Hail Business into Wisconsin

As the company expands its business in the Midwest, it also begins offering other kinds of insurance. In Wisconsin, FMH offers coverage for the first time for specialty crops, including tobacco and canning crops.

1936 FMH Begins Writing Fire Insurance on Town Dwellings

FMH continues to show its dedication to expanding its product line.

1950 - 1990

1950 Writing of Multiple Lines of Insurance is Approved by the State of Iowa

1960 FMH Creates Test Fields to Educate Adjusters

1970 FMH installs its first electronic computer

1970s: FMH Implements Agreement of Settlements Based on a Percentage of Loss

Prior to this change, adjusters had been responsible for calculating loss payment dollar figures in the field, a tedious and lengthy process. In an effort to streamline adjuster’s workload, FMH implements a new system which allows adjusters to reach an agreement with the insured on the percent of crop that is damaged due to hail, then sent to the Home Office to calculate the actual claim figure based on the policy holder’s insurance agreement.

1990 - 2015

FMH Celebrates 100-Year Anniversary

The year-long centennial celebration included special edition pink pencils, a commissioned book about the history of the company, and even an employee choir singing at the 100th annual meeting. The business also reached its first year of $2 billion in-force by the end of the production season in the year leading up to the 100th anniversary.

2005 New Headquarters

FMH moves into new headquarters in West Des Moines and Farmers Union Co-operative also moves office operations from Omaha, Nebraska, to FMH?s new headquarters later in the year.

2011 FMH Property and Casualty Division

On April 1, 2011 Central Iowa Mutual Insurance Association merged into FMH, creating the FMH Property and Casualty Division located in Story City, Iowa.

2014 FMH Mobile

FMH launches FMH Mobile - a free app for producers to access market prices, local cash bids, and even submit auto and property claims right from their mobile device.

2015 FMH Acquires John Deere Insurance Company

On April 1, 2015, Farmers Mutual Hail acquired John Deere Insurance Company, allowing FMH to expand its superior service and expertise to a national market, and bring in new policy and claims reporting opportunities with Precision Ag technology.

2021

FMH achieves the milestone of $1 billion in crop insurance written premium.

In 1996, FMH set a goal - and reached it - of $100 million in premium. Twenty-five years later, the new goal was $1 billion in premium. And once again, FMH reached this goal.

2023

FMH launches Ag Brokerage Solutions™ to expand ag product offerings.

Ag Brokerage Solutions (ABS) is a wholesale brokerage that provides access to a variety of insurance carriers and coverage options, offering a comprehensive outlet for all things agriculture and beyond, to help our partners grow their businesses, and our customers continue their legacies.