FMH Sales Regional Manager Ken Ripley said, “There was lots of excitement and interest in ECO this past sales season. As I’ve said before on our InsureCast podcast, that product has just exploded − growers want high-end coverage.“

With so much interest and an increase in growers who opted for ECO coverage, what do agents need to know about these area products post-sales season?

Q: What’s the main difference between ECO and SCO?

A: Considered a sister product to SCO, ECO is an area plan of insurance with higher coverage levels, where yields are determined on a county-wide basis. While SCO offers coverage up to the 86% level, ECO offers top-end coverages up to 95%.

Q: How does the USDA RMA determine Final Area Yields?

A: One thing to consider with an area plan is the type of crop being covered and how big a production area the USDA Risk Management Agency (RMA) is using for its Final Area Yield. For crops in a county with fewer planted acres, RMA may group several counties together to get a large enough sample size for the loss determination. This can have a major impact on the value of the area-based plan.

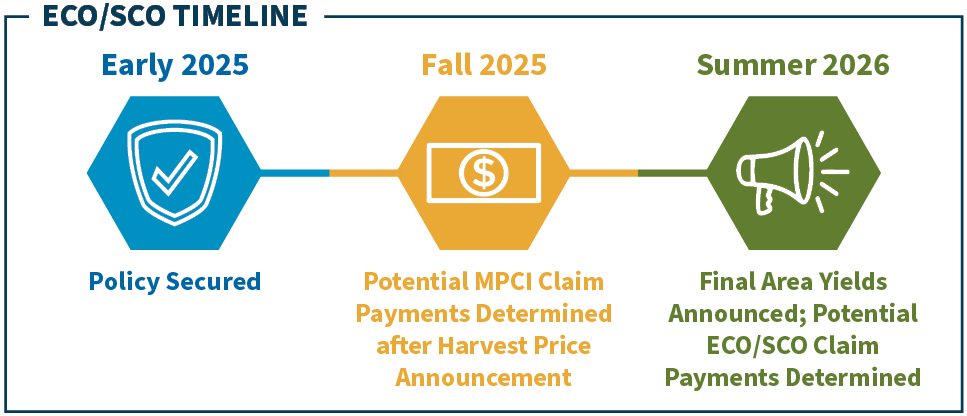

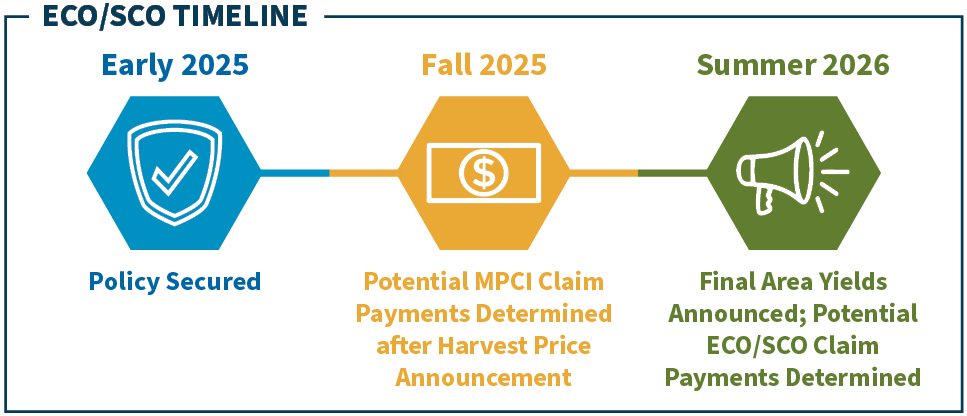

Q: When will potential 2025 ECO and SCO claims be determined?

A: Claim payments or indemnities are determined after the USDA RMA provides Final Area Yields, which is a similar process to Margin Protection (MP) and Area Risk Protection Insurance (ARPI). At the latest, Final Area Yields are available by June 16 the following crop year, so for 2025 policies, an insured likely will not receive a claim payment until summer 2026.

Q: Can insureds receive their underlying plan payment before an ECO or SCO claim?

A: The short answer is “Yes.“ The timing of ECO and SCO payments is not affected by underlying policy claim payments. The underlying policy pays a loss on an individual unit basis and an indemnity is triggered when there’s an individual loss in yield or revenue, which is determined in the fall.

An ECO or SCO indemnity, on the other hand, is triggered by an area-level loss in yield or revenue, which isn’t determined until the following year.

An ECO or SCO indemnity, on the other hand, is triggered by an area-level loss in yield or revenue, which isn’t determined until the following year.

Q: Do insureds receive an ECO or SCO claim when their underlying policy is triggered?

A: Not always, but it’s possible. Insureds can experience an individual loss, but not receive an ECO or SCO payment, or vice-versa. There are three different claim payment scenarios:

- County loss only = possible ECO/SCO payment

- Individual loss only = possible MPCI payment

- Both individual and county loss = possible payment from ECO/SCO and MPCI

Learn more about ECO and SCO products from our in-house experts with our FMH InsureCast podcast.